In the piece posted below, Henry Stewart exposes Osborne’s sleight of hand by using the high level of government debt to justify his cuts – the debt that has grown under Osborne’s stewardship from £960 billion in April 2010, just before the coalition government was elected, to £1.5 trillion five years later. Nevertheless…

UK government interest payments at lowest since war

By Henry Stewart : @happyhenry

Government debt was, in 2010 and 2015, a key element in the general election. The high level of debt is the justification for austerity. Politicians on the right and left have explained that the high cost of servicing the debt prevent spending on health, education and other areas.

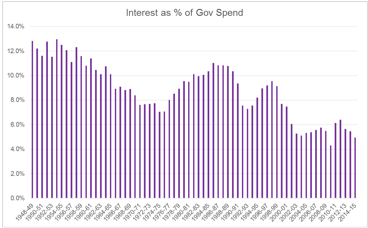

The natural assumption is that this has been such a key issue in 2010 and 2015 because the cost of interest payments on the debts were particular high in those years. An analysis of government statistics reveals that the opposite is the case. The cost of interest payments were, proportionately, at their lowest levels since the war in the years 2010 and 2015.

UK Interest Payments lowest as % of government spending

There are two ways of comparing the cost of interest payments: as a percentage of overall government spending or a percentage of UK GDP. Interest payments were 4.3% of government spending in 2010 and 4.9% in 2015. As the graph below shows, the level was higher in all other post-war years. At the end of the previous Conservative government, in 1997, interest payments represented 9.7% of government spending.

UK Interest payments lowest as % of GDP

UK interest payments are also at their lowest in terms of proportion of GDP. In 2010 the figure was a post-war low of 1.7%. In 2015 the figure was 1.8%, equal lowest with the years 2003 and 2004. In this case the figure at the end of the last Conservative government in 1997 was 3.3%

A key reason for the low cost of interest payments is clearly the low interest rates at which money can currently be borrowed. However, as many economists have pointed out, the low interest rates make this the best time since the war to invest in the public infrastructure rather than cut back.

And if the main problem with debt is the cost of servicing it, why has this only become an issue when that cost is at a post-war low?

These figures are taken directly from the PSF (Public Sector Finances) aggregates databank: http://budgetresponsibility.independent.gov.uk/data/

Contact Details Henry Stewart can be contacted on henry@happy.co.uk,

or on Twitter: @happyhenry

Editor’s note:

William Keegan wrote in the Guardian, October 2015:

Very useful ammunition. Thank you

LikeLike

Pingback: Is the high level of Government debt a justification for austerity? | Think Left | sdbast

The national debt is meaningless, anyone who says otherwise has been brainwashed.

LikeLike

“The national debt is meaningless”

I wouldn’t put it quite like that.

The government has to issue all kinds of liabilities: from 1p coins to £50 notes. £1 premium bonds to gilts and government stock of all denominations.

The total of all govt liabilities is the National Debt (or would be if it was correctly defined). If the govt didn’t accept responsibility for those liabilities no-one else could own them. None of us would have any money (assets). We’d have to revert to a barter economy or start using some other currency like the euro.or even depression.

So, potentially , the problem is not too much debt for the government. Unlike our personal debts it can issue as much debt as it likes and no-one can force it ever to repay. The problem may be that there may be too great a desire in the economy to spend those monetary assets and so cause inflation.

There’s also the problem that there may be too little desire to spend those monetary assets. If so we have a situation of economic recession

LikeLike

The words “or even depression” seem to have been put in the wrong paragraph somehow!

The last sentence should be “If so we have a situation of economic recession or even depression”.

LikeLike

To answer the question in the title of main posting: NO!

The government may need to to cut back on its spending and increase the general level of taxation if too many demands are made on the available resources in the economy resulting in higher than desirable levels of inflation. Technically this is known as ‘demand-pull inflation’. The other possible type of inflation being ‘cost-push inflation’. This type of inflation can result when the economy receives a shock due to the price of a significant commodity, like oil, being substantially increased. There is generally a dispute under those circumstances, in a capitalist society, between capitalists and workers, over who will then pay for that price rise.

The inflation we saw in the 70’s was largely ‘cost push’ and so a ‘demand-pull inflation’ is quite a rare occurrence. It’s really nothing to worry about at all at present.

LikeLike

The “National Debt” is really the “National Savings” or “safe assets.”

Inflation happens when there are multiple bids for resources. So you just make sure one of the bids doesn’t happen.

In terms of public sector contracts you do this by setting a price for the job lower than the market, so that the job – and therefore the spend – doesn’t happen unless there are no alternative offers in the market. That is how the Job Guarantee works by setting the price of labour at a value and letting the private sector bid off the top. But you can extend it to any ‘nice to have’ public sector spend or investment – whether that is insulating houses, replacing barriers down the middle of motorways, clearing weeds in cemeteries, etc..

Or you can use the other powers of government to ban or delay the competition. The classic one is of course the planning system where you can simply say that the schools have to be built before the casinos can start.

You can use the competition arms of government to increase competitive pressure in markets and force dynamic output expansion. Once you have a Job Guarantee you don’t really care too much about businesses surviving and so you can turn up the competitive heat – even to the point of funding competitors at slightly higher prices (Think how National Girobank offering free banking forced all the other banks to introduce free in credit banking). You need to do this as part of oligopoly control, but it also has the advantage of reducing the amount of taxation required. Effectively by squeezing the profit share so they have to work for a living, you create space and output.

Once you understand that tax is simply a hygiene factor – something people are required to do like putting out the recycling – and is only required if saving, import controls, planning controls, competition controls or the myriad of other methods there are fail to nip off demand.

It is just one tool in the modern money toolbox. Yes it is an important tool, but it should be used appropriately. Those who obsess about the taxation hammer are only capable of seeing the world as nails to be taxed. That makes them dangerously inappropriate people for constructing a working modern system.

LikeLike

Pingback: #Grenfell – Negligence beyond Belief | Think Left