ConDemed: The Great Housing and Welfare Swindle Part 1:

A Potted History of the Context of UK Housing & Welfare Policy

By Marxist Nutter previously published here:

Introduction: The Rise and Rise of the New Right

A dangerous new hegemony is emerging from the right and it has been made possible through New Labour’s sedimentation of the Thatcherite hegemony. This new hegemony is the hegemony of austerity.

This hegemony has wide reaching effects in terms of the UK economy and social policy; however nowhere is it more pronounced than in housing. Before going on to look at the effects of the New Right on housing and welfare in the UK, let us first recall its history.

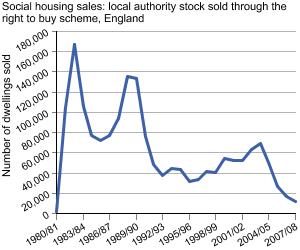

The Thatcher government was responsible for the biggest ever sell off of public assets in the form of the ‘Right to Buy’ (RTB) scheme. Since the 1940s local authorities had been building large amounts of social housing which was affordable for the people of Britain and by the 1980s social housing constituted a very large and important national asset.

(Graph reproduced from http://www.significancemagazine.org/view/index.html)

Thatcher’s RTB sought to sell off social housing to enable social tenants to become home owners. As these social homes were never replaced and building of social homes has been in long term decline, there has been a substantial change in the tenure mix of UK housing, much of which can, to a large extent, be attributed to Thatcher’s RTB policy.

(Graph reproduced from http://www.statistics.gov.uk/hub/index.html)

Research shows that the RTB policy enacted in the 1980s has led to unintended consequences such as the proportion of social homes, sold under RTB, that have ended up as private rented accommodation as opposed to owner occupied, in contradiction to the initial policy aims which were to turn social rented homes into owner occupied homes. Recent estimates suggest that the effect of RTB properties ending up in the private rented sector may have increased benefit expenditure by as much as £2bn per year (Sprigings and Smith 2012). What was once a valuable national asset is now a tool for the generation of private profits which have been subsided by the tax payer, first through the RTB discounts themselves and now through benefit contributions paying for the high private rents being charged by the new owners of what was once social housing.

RTB was certainly an advantage to the generation who were able to buy the council homes under the scheme (and who benefited from significant rises in the value of their property) and is now an advantage to private landlords able to command high rents due to the lack of supply of affordable housing. RTB however has been very costly to the treasury.

Today, the cost of housing benefit is an important political issue; but it is the tenants of the remaining social homes especially who are constructed as the reason for this (as the problem) and not the policy that transferred public assets to private ownership. Certainly, not all in receipt of housing benefit are social tenants, many live in private rented accommodation and some in former social housing which was sold under RTB, and yet this distinction is often blurred in public discourse. It is also true that the majority of people in receipt of housing benefit are either retired or in low paid work, yet in public discourse housing benefit is often linked with unemployment. This is because the New Right have succeeded in framing the housing and welfare debate in a certain way.

The New Labour Years: A New Hope

Thatcher’s greatest success was how she dragged the entire political spectrum to the right by articulating together a critique of Keynesianism with her vision of a strong state and a free market (see the work of Stuart Hall for more details). Thus when even the broken electoral system of the UK managed to reject the Conservatives in 1997, it was unable to reject Thatcher, as her ghost haunted the Blair government even more than the Major government. Labour were never able to challenge neo-liberal orthodoxy. The neo-liberal interpretation of reality had, by this time, become ‘common sense’ – this is perhaps the simplest definition of hegemony. Hegemony is where a single contingent interpretation of reality emerges from a field of multiple possible interpretations to become ‘common sense’ (See Howarth, D. and Stavrakakis, Y. for more details.

By 1997, the prevailing view at the top of the Labour party was that there was no public appetite for socialist principles or an opposition to capitalism, and in order to maintain credibility with the electorate the party must accept a ‘common sense’ view of the world. Privatisation and the fetishisation of the private sector were (and still are) the order of the day. Nationalisation was off the table (let alone workers seizing control of the means of production). Councils, despite successes in previous decades, were viewed as inadequate vehicles to drive affordable housing development.

This new common sense is well articulated in the book On The Edge edited by the Third Way philosophers Will Hutton and Anthony Giddens, (both huge influences on New Labour).

The world’s top corporations …have become not only centres of concentrated economic and financial power; they have become the bearers of the prevailing laissez-faire, globalist ideology. As their economic power grows, so does their political and intellectual reach, at the expense of the nation state that once balanced private economic power with public purposes and national stabilisation policies. The very economic success of global corporations is taken as proof that their world- view has to be correct: that global laissez-faire is the optimal way to organise a modern economy.

[An aside: It is also worth noting (because) that this was not long after the collapse of the USSR and Francis Fukuyama’s famous declaration of the End of History.]

Blair and Brown believed they were largely impotent in the face of the power of global capital and that the only possible way to deal with the neo-liberal reality was to try and mitigate the worst effects of unrestrained capitalism especially for the poor and low paid. New Labour introduced Working Tax Credits in 1999 (as Working Family Tax Credits – see O’Reyes on discourse of Hard working families in Torfing and Howarth eds ) and by the time the coalition came to power Tax Credits accounted for the greatest slice of welfare expenditure. Therefore the biggest single aspect of government welfare expenditure goes to people in work. This fact is rarely mentioned in public discourse, as it does not fit neatly within hegemonic framing of the problem. The second largest aspect of the government’s welfare bill is housing benefit and increasingly housing benefit claimants are also workers in low paid jobs. New Labour, through Tax Credits and Housing Benefit, were thus attempting to address the problem, that increasingly wages in the UK were not sufficient to cover the cost of living, for many low paid workers. Therefore one may argue that rather than subsidising households, New Labour policy was subsidising employers to pay low wages (and thus allowing the UK to be more competitive in the global labour market) by providing benefit payments which allowed workers to cover the cost of living near and/or travelling to their jobs – costs which were/are increasingly not being met through their wages alone.

Meanwhile New Labour encouraged local authorities to either sell off their housing stock to housing associations (Large Scale Voluntary Transfers or LSVTs) or to separate out the management function of social housing from other council functions through the creation of arms-length management organisations (ALMOs). LSVTs had access to credit which local authorities did not and due to changes to the housing funding regime ALMOs had access to funds to improve their neglected (council) housing stock. In addition, the Audit Commission and its inspection regime was used as a hammer to bash housing providers, of all kinds, ‘into shape’. Therefore through a combination of heavy handed inspection and regulation, the availability of grant funding and various ‘public-private’ solutions, and the diversification of social housing (through the Housing and Regeneration Act) to include certain home ownership and near market rented ‘products’ (an so open the door to cross subsidisation within the housing sector), New Labour were able to improve the quality of a great deal of the nation’s (remaining) social housing stock. However, once again, a big part of the New Labour solution involved throwing money, not at the problem per se, but the symptoms caused by the problem. Grant funding of new build social housing was expensive and did not generate anything like as many new homes as the local authority led building programmes of the mid 20th century. The Audit Commission may have improved standards, in some cases, but was an expensive and unwieldy beast that hammered in a ‘one size fits all’ approach to housing management through its Key Lines of Enquiry (KLOE) inspection regime and so arguably stifled innovation meaning that many of the (perceived) advantages of privatisation were perhaps not fully realised.

All in all the New Labour approach of avoiding the problem and mitigating its effects was very costly and involved a great deal of public and private borrowing; but nevertheless did succeed in insulating the nation’s poor and low paid from the worst effects of global capitalism.

The Credit Crunch: The Revenge of the Markets

New Labour’s approach was to mitigate the effects of global capital and not challenge it, for they felt impotent to do so. There was also, no doubt, an element of hubris to their approach in the form of their belief in neo-liberal doctrine; the inexhaustibility of cheap finance and the mistaken notion that they had ‘put an end to boom and bust’. I have noted how they used the benefit system to subsidise low wages and allow British businesses remain competitive in a global marketplace. This combined with the easy availability of credit, underwritten by rising house prices, allowed the majority of people to not perceive the effects of long term wage stagnation. For this reason the stagnation of wages was not commonly constructed as a problem within mainstream politics or the media. This stagnation was caused by the greater problem, of which it was a symptom, which is global capitalism – the very problem that ‘common sense’ dictated was impossible to address, and indeed did not ‘feel’ like a problem for much of their time in power. New Labour, in a sense, constructed a ‘house of cards’ from the benefit system which was propped up via government borrowing and masked by the availability of credit to ordinary consumers. This ‘house of cards’ was how New Labour sought to reduce the effects of the core problem it either did not perceive or felt it could not address. The housing benefit bill continued to rise as did rent levels. New Labour were both paying for the increasing costs of lack of affordable housing supply (through benefit payments) and, at the same time, paying out grants to address this problem. This, in retrospect, was a very expensive and ineffective (in terms of the generation of new housing supply) approach. It also generated a ‘slow burn’ of resentment among the population, who perceived more and more people ‘living on benefits’; living in better quality housing at the expense of the public purse. This resentment probably was exacerbated by issues with immigration, which I do not have the space to discuss here; but was also, for the most part, mitigated by the availability of cheap credit for many people and, for home owners, the fact the increasing price of their property was offsetting their mortgage.

However, in 2008, with the global financial crash, New Labour’s house of cards came tumbling down. The over-exposure of private lenders to risks based on the over-valuation of certain financial products (many of which, based in the last instance, on house values) became apparent. This phenomenon first arose in the USA, but due to the inter-connected nature of global capital, its effects penetrated every aspect of the global markets. With banks in trouble suddenly what was impossible for manufacturing firms years earlier became possible; and the government found billions of pounds to bail them out. The availability of credit was so crucial to the neo-liberal project and to New Labour’s ‘house of cards’ that the banks could simply not be allowed to fail. There are numerous issues that could be discussed at this juncture such as: the contradiction that high salaries/bonuses are justified due to the risks entrepreneurs take; yet when push came to shove these risks were borne by the state, the issue that global capitalism meant it was impossible for government to save manufacturing industries and people’s jobs, yet when the finance industry was in trouble suddenly the impossible became possible; however although these are fascinating topics, discussing them in depth would lead this article astray.

My interpretation of events was that, faced with a dislocatory event that threw New Labour ‘common sense’ into disarray, Gordon Brown’s administration fell back into the conventional wisdom of Keynes. There was also, no doubt, a realisation that their entire house of cards was built on the availability of credit and as such the government felt compelled to do all it could to sure up the banks and encourage them to keep lending. Certainly there is some evidence to suggest that Brown’s small scale Keynesian stimulus was a more effective short term response to the crisis than current Coalition policy. Whatever the reasons, the decision to bail out the banks transferred the private debt crisis into a sovereign debt problem. This certainly impacted the ability of any future government to continue with the approach to housing and benefits pursued by New Labour during the late 90s and early 21st century.

The New Right Strikes Back

The other result of this crisis was that the issues of wage stagnation were no longer as well masked by credit. The resentment of the welfare system was also made more acute as people on middle incomes started to feel the pinch (although this did not happen right away). As much as I think this was a factor it is an inadequate explanation for the increasing feeling that the benefit regime was too generous.

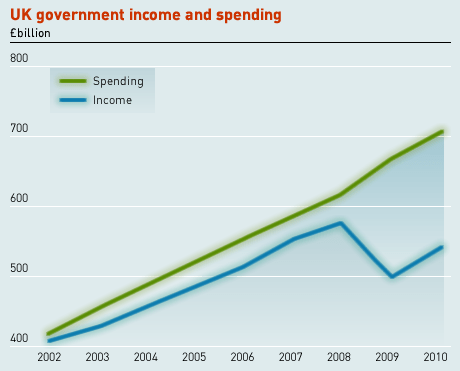

It seems probable, if not likely, that at least some of those who are resentful of the benefit regime would also be on low wages and so are the major (in monetary terms) beneficiaries of the system. Therefore the growing resentment with welfare and benefits from those who gain most from the system appears irrational. What is crucial here is how the argument was framed. The media, to the great benefit of the forces of fiscal conservatism, managed to construct the credit crunch as a problem with public spending. In fact the data do not seem to support such a simplistic interpretation. Certainly New Labour had, as I have already noted above, pursued a very expensive approach to dealing with the effects of wage stagnation, however the massive gap between revenues and spending (the budget deficit) that happened in 2008 was largely due to a huge drop in revenue from taxes (see graph below) and to a lesser extent from the decision to prop up the banks (the financing of which is often excluded from the measurements of public spending).

(Graph Reproduced from http://falseeconomy.org.uk/)

The discourse that the New Labour had ‘run up the national credit card’ gained currency (became hegemonic) and became the dominant, if misleading on a number of fronts, interpretation of the problem. This then allowed for another very clever sleight of hand. Drawing on a certain pre-existing resentment with the welfare system, beefed up with evidence that welfare spending was set to increase massively (for the reasons outlined above) the new Coalition government (that came to power in May 2010) were able to detract emphasis and public anger which, at the time, was well and truly aimed at banks, MPs and the wealthy (interests strongly aligned with the Conservative Party) and direct it toward welfare recipients. This involved a slippage in how the evidence was constructed and presented through conflating the ever increasing benefit bill with a very small hardcore group of unemployed benefit claimants. As we have seen, the increasing benefit bill was/is in fact driven by the combination of stagnant wages and increasing house prices, which in turn is caused by global market pressures and the lack of affordable housing supply (caused in part by the RTB policies of the 1980s). Unemployment benefits actually make up a very small proportion of the overall benefit bill and are lower than most comparable nations.

Benefits in the UK are comparatively lower than other industrialised countries; with one of the lowest benefit rates relative to earnings. In addition the actual value of benefits in the UK has declined over the last thirty years due to a change in the policy of up-rating benefits.

So the Coalition government (together with the right wing press) successfully and misleadingly conflated the rising cost of benefits with the image of the ‘lazy scrounger’ who has no job and ‘lives off’ benefits and thus developed a hegemonic discourse of the ‘lazy scrounger’ who is responsible for the rising cost of welfare expenditure. The reason why the coalition has been so successful in hegemonising this interpretation is due to what we can call (following the French Psychoanalyst Jacques Lacan) the ‘fantasmatic’ dimension of the discourse. The notion of the benefit scrounger closely follows the contours of the ‘stolen enjoyment thesis’ identified by political theorists David Howarth, Jason Glynos and Yannis Stavrakakis. The theory is quite complicated here and not easily put in a ‘nutshell’, so I will quote at length:

The promise of a full enjoyment which escapes our attempts at identificatory capture and which serves as the motor of desire is linked to what Lacan calls the objet petit a, the object-cause of desire, and it is this object which forms the centre-piece of a subject’s fantasy. When Lacanians say that fantasy supports reality …, they tend to mean that the credibility and salience of any object of identification relies on the ability of the fantasmatic narrative to provide a convincing explanation for the lack of total enjoyment. Ontologically, of course, this lack of total enjoyment is necessary. However, in the subject’s economy of desire this ‘truth’ must be actively forgotten, and it is this dialectic of confrontation with, and denial of, lack, which gives rise to the logic of fantasy. Indeed, oftentimes the cause of the lack of enjoyment is attributed to someone who has ‘stolen it’. Romantic nationalist histories, for example, are frequently based on the supposition of a golden era (Ancient Greece and/or Byzantium for modern Greek nationalism, the Jewish kingdom of David and Solomon in many versions of Jewish nationalism, etc.). During this imagined golden age, the nation was prosperous and happy, only to be later destroyed by an evil ‘Other’, someone who deprived the nation of its enjoyment. Typically, nationalist narratives are rooted in the desire of each generation to try and heal this (metaphoric) castration, and give back to the nation its lost full enjoyment. The identity of the evil ‘Other’ who prevents the nation from recouping the enjoyment it has lost shifts as a function of historical context. It may be a foreign occupier, those who ‘always plot to rule the world’, some dark powers and their local sympathizers ‘who want to enslave our proud nation’, immigrants ‘who steal our jobs’, etc. In this view, the obstacle to full enjoyment shifts depending on the specificity of the fantasmatic narrative at stake, but the formal logic remains the same.

‘Benefit scroungers’ are, as such, constructed as the (horrific) obstacle preventing the majority from enjoying ‘full enjoyment’ – ‘the evil ‘Other’’ (illustrative example). In this ‘fantasy’ the benefit scrounger is constructed as the reason for high government spending and while they (the benefit scrounger) enjoy a ‘champagne lifestyle’ courtesy of the state, we (non-scroungers) are having to make sacrifices and cut backs. The fantasy is thus that if the ‘benefit scroungers’ are dealt with (the obstacle is overcome) then the nation will be better off and the majority can reach full enjoyment by no longer having to make cut backs. It is thus that ‘benefit scroungers’ are constructed as the obstacle – as stealing our enjoyment – the reason that we must live as we do and not as we would like to. This can be further sedimented by the fact that people often report knowing somebody ‘who never works and enjoys sitting in the pub, living the high life on benefits’. This allows them to give a real ‘face’ – an example – in which they can fully emotionally invest in as the target – as the ‘they’ which are stealing ‘our’ potential full enjoyment. See the following as an example of how this fantasy is constructed at the fringes of official discourse.

Mr Bateman’s daughter Jessica, 18, who is from a previous relationship, said she was ashamed of her ‘useless’ father. She said he walked out on her family when she was five years old. ‘I am so ashamed of him. That family seems to be living the life of Riley, when my family works hard to earn a living and can’t afford half of what they can,’ she said. ‘They go out for McDonald’s meals that cost £60 a go and yesterday one of Joanne’s daughters had a stretch limo ride for her 13th birthday. ‘If my dad can ride that motorbike he has in his back garden then he can sit on a till somewhere. It is just pure laziness.’

From the Daily Mail

Articles such as this back up tough government policy on welfare, allowing government MPs to draw on the vilification of people on benefits without explicitly vilifying them themselves. Consider, for example, the following David Cameron quote, in the context of the Daily Mail quote, above:

We should ask this question about housing benefit: if you’re a young person and you work hard at college, you get a job, you’re living at home with mum and dad, you can’t move out, you can’t access housing benefit. And yet, actually, if you choose not to work, you can get housing benefit, you can get a flat. And having got that, you’re unlikely then to want a job because you’re in danger of losing your housing benefit and your flat.

(David Cameron on the Today Programme September 2012)

The coalition (aided by right wing media at the margins of official discourse) have also a managed to conflate the ‘benefit-scrounger’ with the social housing tenant. However this has not been a simple process. In fact the social construction of social tenants has oscillated wildly under the current government depending on which policy they seek to emphasise. When advocating a policy that seeks to ‘re-invigorate the Right to Buy’ social tenants were seen as aspirational and hard-working; however when it came to welfare reform they were benefiting from a subsidised public asset. A key part of this process is the creation of the term ‘a culture of dependency’ which was best expressed by a Policy Exchange report which blamed social housing for poverty and dependency on benefits.

[…]evidence of the dependency caused by social housing under the existing system comes from the fact that even in 2007, before the recession began, 63% of social housing tenants in housing associations were reliant on Housing Benefit to pay their (already subsidised) rent Source

This short quote is full riddled inaccuracies, not least that social rent is somehow subsided, which is, by no means, an uncontroversial assertion. I have already noted, elsewhere, the approach to evidence taken by the author of this report…

Having briefly outlined the context of current UK housing and welfare policy, Part 2 will focus on present policy and briefly examine strategies for challenging it.

Reblogged this on thelondonwizard.

LikeLike

Pingback: ConDemed: The Great Housing and Welfare Swindle: Part 2 | Think Left

Excellent work.

And during this period, the great old-conservative goal of home ownership for all has been abandoned as the concentration of homes into the hands of fewer and fewer (subsidised) rent-seekers continues. I honestly don’t think Thatcher et al saw that bit coming, but capitalism always seeks a free-ride. Solutions will have to be long term, painful & redistributive, starting with sensible interest-rates, restrictions on ownership (eliminate property holding off-shore trusts), punitive land / death / inheritance taxes; alongside new building, reclamation.

LikeLike

Pingback: Monopoly and the Landlords’ Game | Think Left

Pingback: The Landlords’ Game and the Opportunists | Think Left